Hopeful Mt. Gox creditors are finally seeing some light at the end of the tunnel, but the news makes some crypto investors afraid.

The defunct exchange, which collapsed in 2014 after a hacker attack, has moved over 75000 bitcoin (around $5 billion) for the first time in five years.

This massive transfer comes months ahead of a deadline for Mt. Gox to repay creditors with bitcoin and other assets – a prospect many have been waiting for years.

Good news or bad news?

The big question on everyone’s mind is what will the creditors do with their recovered funds?

This $5 billion bitcoin transfer has indicated fears of a major market sell-off, as some worry creditors will dump their bitcoin onto the market, causing a significant price dip. After years of waiting, will they finally cash out?

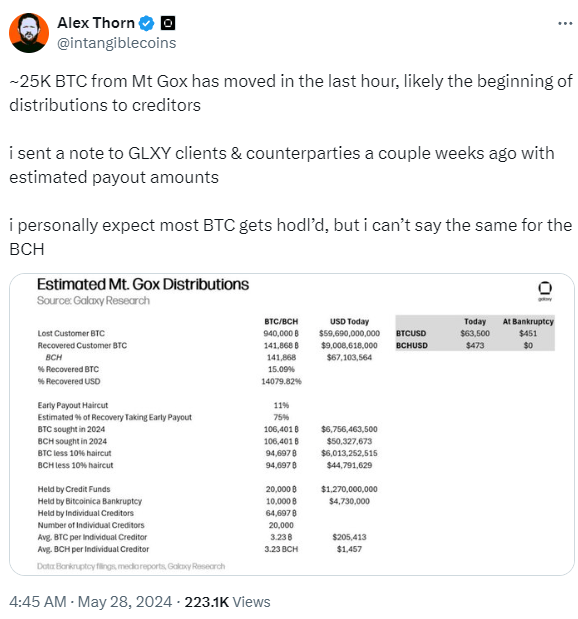

Analysts and experts are divided on what the creditors might do.

Some, like Alex Thorn from Galaxy Digital, believe they’ll hold onto their bitcoin, viewing it as a long-term investment, but others fear a flood of bitcoin hitting the market as creditors choose to sell.

Red alert

The news has already caused a small sell-off in the market, with bitcoin prices dropping by nearly 4% after the transfer.

This initial reaction highlights the potential impact these recovered funds could have on the price.

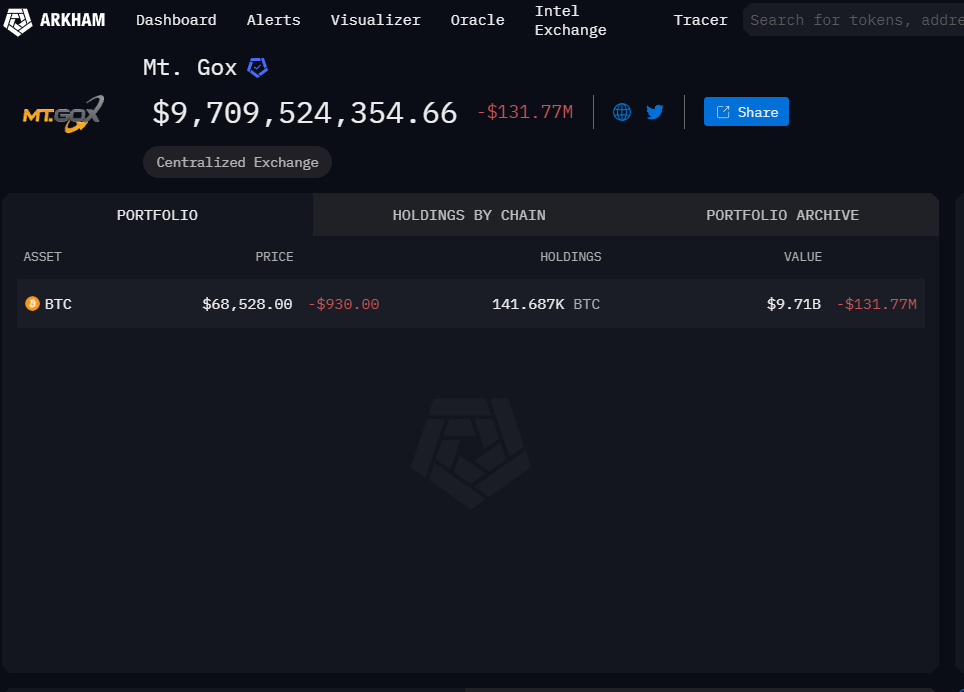

While the transaction shows progress, finally, it’s good to know that Mt. Gox still holds a significant amount of bitcoin, roughly $9.3 billion worth.

The full repayment process is expected to include not just bitcoin, but also Bitcoin Cash and Japanese yen, with a deadline set for October 31st, 2024.

Market watch

The Mt. Gox saga has dragged on for nearly a decade, leaving creditors waiting anxiously for their lost funds, and this recent development offers a glimmer of hope for long-awaited relief.

What we don’t know, how will the owners act, the potential market impact of these recovered funds remains a cause for concern.

Only time will tell how this story ends and whether creditors will choose to hold or sell, influencing the price of bitcoin.