The popular crypto exchange has reportedly fallen victim to a major hack, with estimates suggesting $37 million has been drained from its hot wallets.

This incident is the first big exchange breach of the year.

Red alert

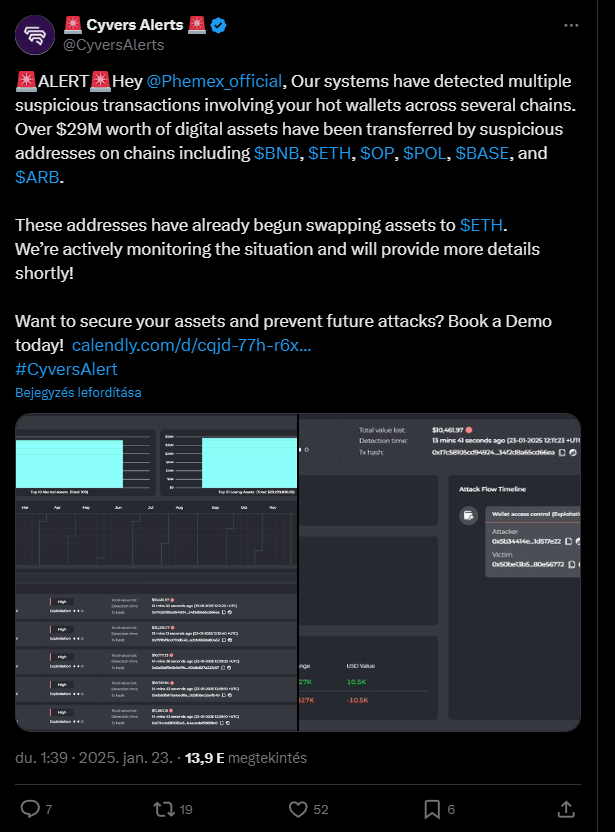

On Thursday morning, reports started flooding in about suspicious activity linked to Phemex’s hot wallets, and blockchain security firm Cyvvers was quick to jump on the case, revealing that hackers had funneled over $29 million worth of various cryptocurrencies to shady wallets across multiple chains.

After further investigation, the total loss was adjusted to around $37 million, including assets from Bitcoin and TRON networks.

The hackers didn’t just stop at one type of coin, but they made off with a mix of assets including 3.48 million USDC, 3.42 million USDT, and 841 ETH.

They also looted 110,701 LINK, 142 billion PEPE, and several other tokens, totaling around $7.3 million combined.

Phemex responds

Phemex’s CEO Federico Variola confirmed that one of their hot wallets had indeed been compromised, and reassured users that their cold wallets remain secure and emphasized that they are investigating the situation thoroughly.

To keep users safe, Phemex temporarily halted all withdrawals while they ramp up security measures and conduct an emergency inspection.

They posted on X, apologizing for the inconvenience and promising that trading services would continue as usual, and the team is also working on a compensation plan for affected users, which will be revealed soon.

A growing concern in the industry

This hack isn’t just an isolated incident, it’s part of a quite worrying trend in the crypto world.

In 2024 alone, hackers stole over $2.2 billion, marking the fourth consecutive year that crypto thefts exceeded a billion dollars. Centralized exchanges were particularly hard hit, with 303 incidents reported last year.

Have you read it yet? Trump launches new initiative to boost digital assets

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.