We’ve got a busy week ahead that could really impact the markets as the U.S. economy kicks back into gear for the new year.

After a rocky end to 2024, the crypto industry is buzzing with renewed energy, and Bitcoin is leading the charge.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

It’s time for new gains?

Over the weekend, Bitcoin and other cryptocurrencies held onto gains made late last week, thanks in part to a little so-called Santa rally that brought around $280 billion into digital assets. But what’s on the agenda this week?

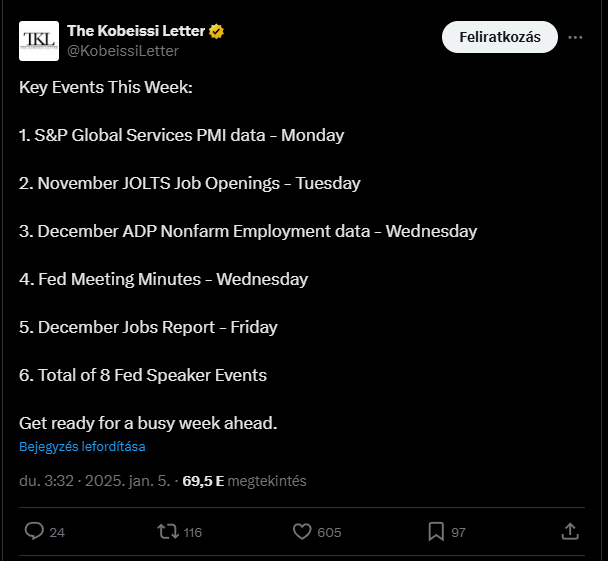

This week is packed with important economic reports that could influence market sentiment.

On Monday, we’ll see the S&P Global Services PMI, which gives us a peek into business conditions in the services sector. Tuesday brings the ISM Services PMI, another key indicator for economists and analysts.

Then it gets serious with labor market data. Tuesday will also feature the JOLTS Job Openings report, followed by the ADP Nonfarm Employment data on Wednesday.

These reports will show how many jobs are available and how many people are actually getting hired. So we won’t be bored at all.

Do you feel the pull of the weekend?

Friday is when things get really interesting with December’s Nonfarm Payrolls and Unemployment reports.

These figures will tell us how many new jobs were created last month and what percentage of people are actively looking for work, and these stats are pretty important as they give us insight into the overall health of the economy.

Also on Friday, we’ll get January’s Michigan Consumer Sentiment Index and preliminary readings on consumer inflation expectations.

This data will reveal how confident consumers feel about the economy and their thoughts on inflation moving forward.

Crypto market outlook

As for crypto, market capitalization has been pretty stable lately, sitting at around $3.68 trillion, after Bitcoin is riding high, hitting a ten-day peak of over $99,000 during early trading in Asia on Monday morning. That’s a solid 7.5% gain over the past week, not bad at all.

Post-breakout Quarterly Retest and Trend Continuation confirmed$BTC #Crypto #Bitcoin https://t.co/T5fYyyybjH pic.twitter.com/geXSv4SYue

— Rekt Capital (@rektcapital) January 5, 2025

Ethereum is also following suit, climbing to around $3,700 in the time of writing, its highest price since December 19.

Most alts are holding steady after their weekend gains, setting up for what could be an exciting week ahead.

The Kobeissi Letter has warned about potential ripples from China’s real estate collapse affecting markets worldwide. As we head into 2025, they’re expecting more volatility.