It looks like Dogecoin might be gearing up for a massive, giant price surge, with historical patterns suggesting a potential rally of up to 12,000%.

Pattern recognition

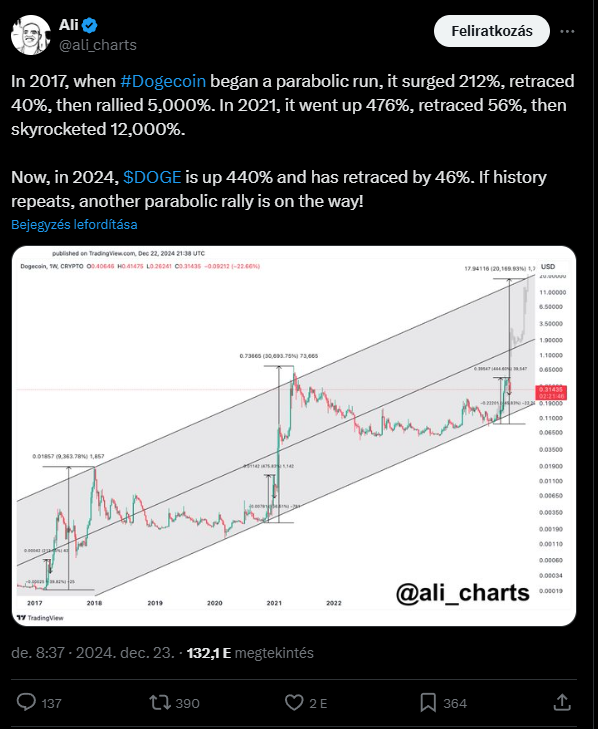

Dogecoin has a history of wild price swings, and it seems to be following that trend again. Back in 2017, DOGE shot up by 212%, then took a breather with a 40% correction before skyrocketing by 5,000%.

2021 pretty much the same. We saw a similar story, a 476% increase followed by a 56% drop, only to later surge by 12,000%.

Now, in 2024, Dogecoin has already climbed 440%, jumping from $0.065 to $0.39547 before pulling back by about 46%, and a popular crypto analyst, Ali thinks that if this pattern continues, we could be looking at another crazy rally soon.

Doge chained

As of now, Dogecoin is trading at around $0.3167. This reflects a slight dip of 1.43% in the last day and a more notable drop of 21.23% over the past week, but don’t forget that DOGE boasts a market cap of $46.66 billion and a trading volume of $4.37 billion in the last 24 hours.

DOGE is holding steady within its long-term price channel, and analysts have identified support levels at $0.065 and between $0.19-$0.20, while resistance is noted at $0.39547 and the previous all-time high of $0.73665 set in 2021.

If Dogecoin keeps up its historical momentum within this channel, some analysts project an upper limit of $17.94! It’s unbelivable, actually, but there’s a chance.

More and more active addresses

Data shows that as of December 11, there were 136,850 active addresses with nearly 59,000 new ones popping up.

That’s an increase of over 102% for new addresses and more than 111% for active ones over the past week.

The growth in address activity coincided with Dogecoin’s price climb to around $0.40 and suggests renewed interest from both retail and institutional investors.

Whale transactions are also on the rise; last week saw about 9,410 large transactions compared to just 2,450 on November 8.