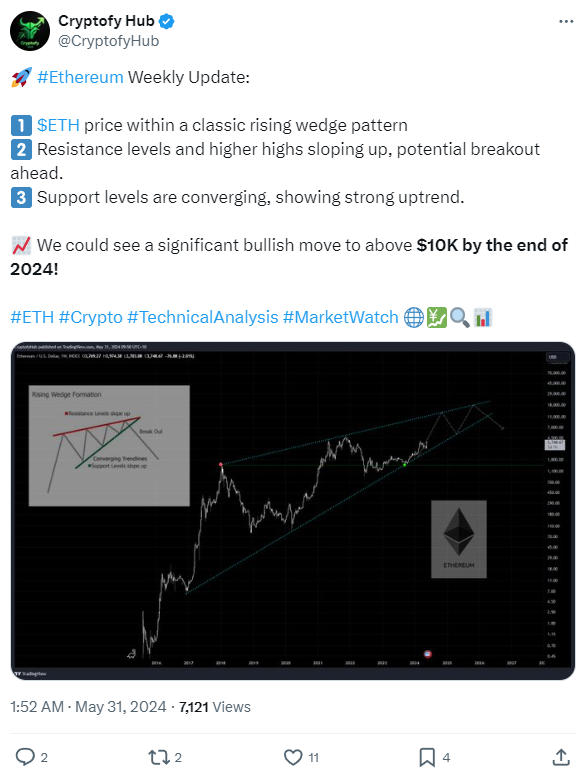

Cryptofy Hub, a popular cryptocurrency analytics platform, has posted in social media that Ethereum (ETH) could reach $10,000 by the end of this year, based on the historical patterns.

In the X post, the platform pointed to a rising wedge pattern in Ethereum’s multi-year chart, with both resistance and support levels trending upwards.

According to Cryptofy Hub, this converging support indicates a strong uptrend.

Is this bullish?

Typically, technical analysts view a rising wedge pattern as a bearish signal, suggesting a potential downside breakout.

Cryptofy Hub still remains optimistic about Ethereum’s growth, predicting it could hit $10,000 by year-end, and this time, the fundamentals might support their sentiment.

Despite some skepticism from users, who foresee a harsh bear market in 2025-2026, the platform’s bullish outlook remains.

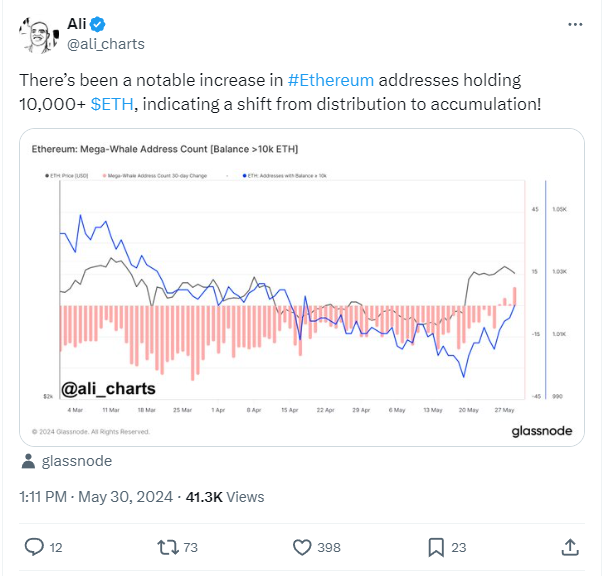

Whales are accumulating

This optimism is strenghtened by increased whale accumulation of Ethereum, as analyst and trader Ali Martinez noted a significant rise in wallets holding at least 10,000 ETH, suggesting a market shift from distribution to accumulation.

IntoTheBlock data also shows a 7% increase in whale transaction value over the past 24 hours, supporting this narrative.

ETFs open the floodgates?

The recent approval of the first-ever spot Ether ETFs in the U.S. by the SEC has also contributed to the bullish sentiment, and this news even temporarily pushed Ethereum’s price close to $4,000 before it corrected sharply.

At the time of writing, Ether is trading around $3,700 after showing little movement over the past 24 hours.

The introduction of spot ETFs could lead to price appreciation, similarly like in case of Bitcoin, growing the user base and possibly starting a bull run in the cryptocurrency market.

If these projections hold true, Ethereum’s anticipated rise could causing strong euphoria for investors and the overall crypto ecosystem.

Have you read it yet? There are 52,5 million active Bitcoin-addresses now

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.